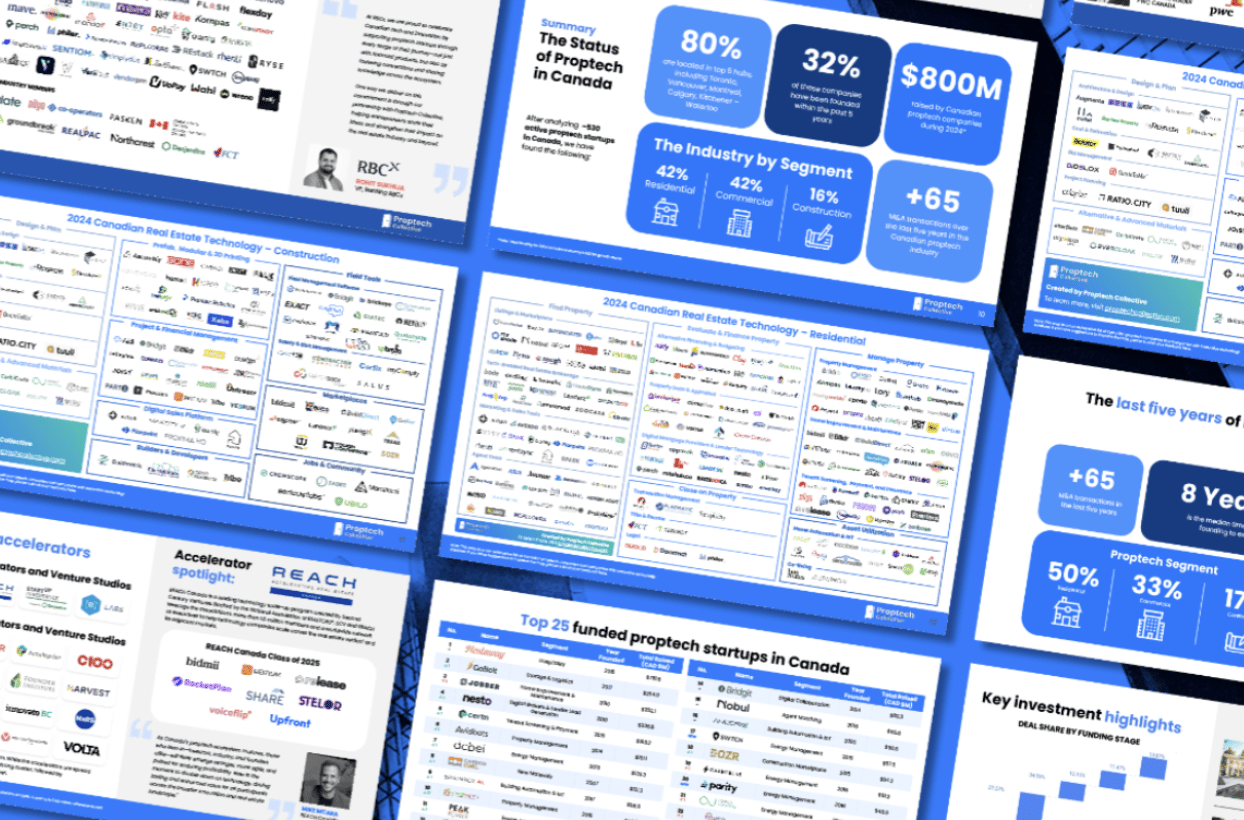

While Proptech in Canada latest report is national, Vancouver consistently shows up as one of the country’s most important proptech hubs — and in a few areas, it’s punching above its weight.

Vancouver is one of Canada’s six core proptech hubs

Roughly 90% of Canadian proptech companies are concentrated in six cities, with Vancouver firmly in that top tier alongside Toronto, Montreal, Calgary, Kitchener-Waterloo, and Edmonton.

British Columbia accounts for ~18% of all Canadian proptech startups, second only to Ontario. That makes Vancouver the clear West Coast centre of gravity for real estate and construction technology.

Why it matters: For founders, this density shortens the path to customers, pilots, and partnerships. For investors, it creates deal flow with real peer benchmarking — not isolated one-offs.

Vancouver skews toward climate, energy, and building performance

While Toronto dominates transaction-heavy residential platforms, Vancouver’s proptech ecosystem is more heavily oriented toward:

Energy management

Building automation and IoT

Sustainability and decarbonization

Construction productivity and materials

This lines up closely with:

BC’s climate policy environment

Local expertise in cleantech and engineering

Demand from institutional real estate owners operating in BC and the Pacific Northwest

Investor takeaway: Vancouver proptech often looks less like “real estate SaaS” and more like climate + infrastructure tech — with longer sales cycles but deeper strategic value.

AI adoption is strongest where labour is tight — which favours Vancouver

The report shows AI moving from experimentation to execution across construction and commercial real estate workflows. Vancouver companies are well positioned here because:

Construction labour shortages are acute in BC

Projects are complex, regulated, and capital-intensive

AI-driven efficiency gains have immediate ROI

Many Vancouver-based founders are using AI to:

Reduce headcount growth

Compress delivery timelines

Support compliance, inspections, QA/QC, and reporting

This “do more with less” mindset aligns closely with the capital discipline investors are now demanding.

Vancouver founders are building for strategic exits, not IPOs

Across Canada, proptech exits are increasingly expected to come through strategic M&A, not public markets — and this is especially true in Vancouver.

Local startups are often:

Selling into large real estate owners, developers, utilities, or construction firms

Building technology that complements physical assets and long-term infrastructure

Designing products with eventual acquirers in mind

This is a feature, not a bug. Vancouver founders tend to build companies that solve real operational problems — which makes them attractive acquisition targets, even if they’re not venture-scale unicorns.

Government spending is a quiet tailwind for BC startups

Federal housing and infrastructure initiatives (including Build Canada Homes) explicitly prioritize:

Modern construction methods

Productivity improvements

Low-carbon materials and systems

BC-based companies working in prefab, modular construction, energy efficiency, or construction automation are well aligned with where public capital is going, even if procurement timelines are slow.

For Vancouver founders, the opportunity isn’t hype — it’s learning how to sell into government-adjacent ecosystems.

The Vancouver takeaway

Vancouver isn’t trying to out-Toronto Toronto.

Instead, it’s emerging as:

Canada’s West Coast hub for climate-aligned proptech

A testing ground for AI in real construction workflows

A market where capital efficiency and partnerships matter more than blitzscaling

For founders, that means building patiently but with conviction. For investors, it means Vancouver remains one of the most credible places in Canada to back proptech right now — especially if you’re thinking long-term.